How Does the State Budget Impact Your Budget?

As costs have grown at increasingly unaffordable rates over the past four years, Washingtonians are more and more focused on their incomes and expenses as they make their household budget decisions.1 But the fastest growth rate of all has been the growth of state spending.

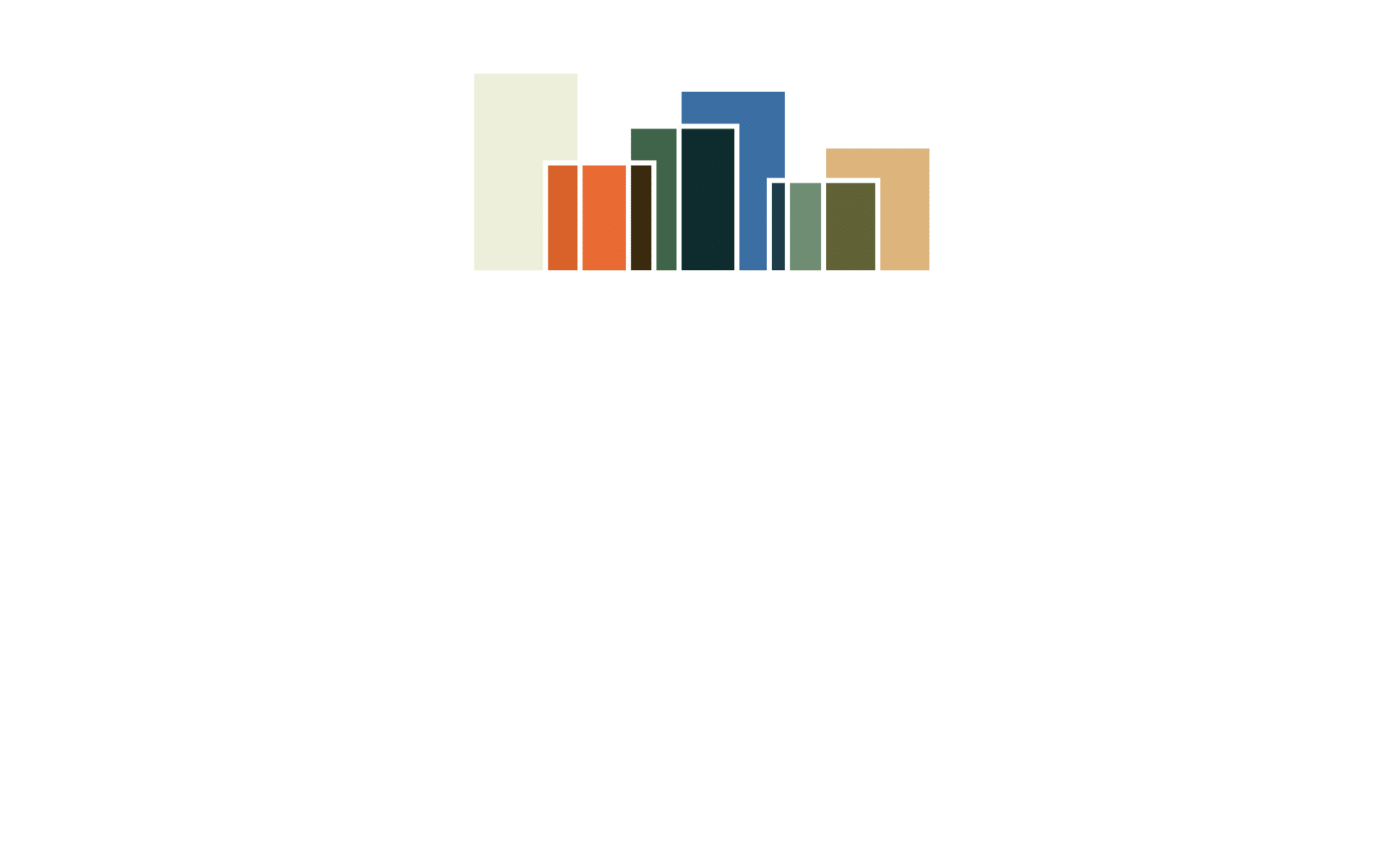

State tax and spending growth:

- The state is collecting more tax revenue than it ever has.2

- In the past decade, state tax collections have grown by 94%.3

- State spending in that time has grown by 114%.4

Household income, household impacts:

- Over the past decade, median household income has grown by 58%.5

- During this time, state spending per capita has grown from $6,000 to $9,000.6

Growth of basic living costs in Washington:

- Washington has the 3rd highest cost of living in the nation.7

- Since 2021:

- Consumer prices in Washington have grown to the 5th most of any state in the country.8

- Gas prices have grown 18%9 and are among the highest in the nation.10

- Childcare costs have grown 21 percent.11

- Grocery prices have grown 20 percent13 and are the 4th highest in the nation.14

- Housing costs have grown 8%15 and are the 5th highest in the nation16.

- State spending has increased nearly 40%.17

As the state brings in money at a faster rate than Washington households, while spending more than it has coming in and at a faster rate than other rising costs, it makes sense to ask: How does the state budget impact your budget?

Sources

Source:

[2] https://erfc.wa.gov/sites/default/files/public/documents/meetings/rev20241120_0.pdf

[3] https://erfc.wa.gov/sites/default/files/public/documents/publications/nov24pub.pdf

[4] https://fiscal.wa.gov/Spending/SpendHistFundBienChart

[5] https://www.statista.com/statistics/206032/median-household-income-in-washington/

[6] https://researchcouncil.org/wp-content/uploads/LegPassed2024Supp.pdf

[7] https://www.usnews.com/news/best-states/rankings/opportunity/affordability

[9] https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=pet&s=emm_epm0u_pte_swa_dpg&f=a

[10] https://gasprices.aaa.com/state-gas-price-averages/

[11] https://childcareawarewa.org/data-advocacy/child-care-data-statistics/

[12} https://www.newsweek.com/most-expensive-state-child-care-1984327

[14] https://www.helpadvisor.com/community-health/cost-of-groceries-report

[15] https://www.redfin.com/state/Washington/housing-market

[16] https://www.fool.com/money/research/average-house-price-state/